ISAPS data shows that the global medical beauty market size has achieved steady growth from 2015 to 2019, with a compound annual growth rate of approximately 8.2%. In 2019, the global market size exceeded one trillion yuan, a year-on-year increase of 7.5%, and is expected to reach 1,782 US dollars in 2022.

Compared with the United States, Japan, South Korea and other countries, my country's medical beauty industry started late and grew faster. In recent years, the market penetration rate has been steadily increasing, from 2.4% in 2014 to 3.6% in 2019. This figure is still rising, and the market potential is huge.

The fundamental reason why the medical beauty industry is booming is that it has a good economic ecology. As early as 2019, according to data released by the National Bureau of Statistics, China's per capita GDP has exceeded US$10,000. This prerequisite objectively provides economic support for medical beauty consumption.

In addition, the gradual improvement of national policies and the continuous addition of industrial capital have provided a good industrial environment for the development of the medical beauty industry. In addition, the rise of the "appearance economy" has brought about an increasing demand for medical beauty, which has driven the upgrading and progress of medical beauty technology and industry.

As those born in the 1990s and 2000s gradually become the mainstream consumer group of contemporary society, the consumption awareness and patterns of the people will also change accordingly. Medical beauty will only become a consumption front for more people, and the market space and time will also be further expanded.

The structure of the emerging medical beauty industry chain includes upstream medical beauty consumables and raw material manufacturers, as well as mid- and downstream medical beauty institutions, public and private plastic surgery hospitals, and a large consumer group. Traditional medical beauty projects have a shorter timeline, and the application scenarios and target groups are also very limited. Good money drives out bad money, which is an unchanging market law. Therefore, the rise of emerging medical beauty is unstoppable.

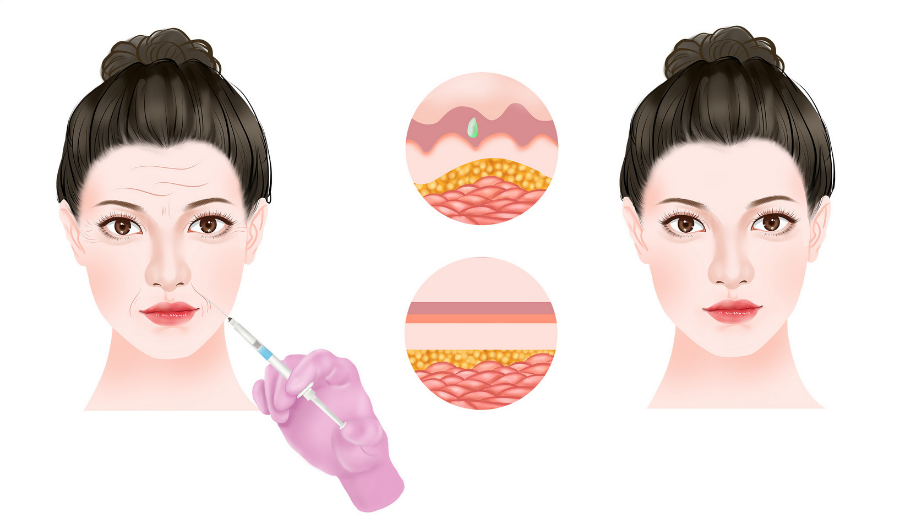

Medical beauty projects can be divided into two categories according to whether surgery is required: surgical and non-surgical. Among them, the non-surgical category has become the hot new star among all medical beauty projects due to its greater safety, operability, and affordability. It is also called light medical beauty, which includes injections, skin beauty and other aspects.

Lower risk and faster recovery speed, these two advantages make consumers prefer light medical beauty when choosing. In recent years, my country's light medical beauty market has continued to grow at a faster rate than the industry as a whole. In 2019, the scale was about 60 billion yuan, and the share of the medical beauty market rose to 42%; the compound growth rate of the light medical beauty market from 2014 to 2019 was about 24.6%; according to Frost & Sullivan, the scale of my country's light medical beauty market is expected to reach 144.3 billion yuan in 2024, corresponding to a compound growth rate of 19.2% from 2019 to 2024.

Hyaluronic acid occupies half of the light medical beauty market

According to ISAPS data, hyaluronic acid accounted for 32% of global non-surgical medical beauty projects in 2019, which is close to one-third of the entire project. In my country's injectable medical beauty market, the factory output of hyaluronic acid in 2019 reached 3.6 billion yuan, making it one of the two major projects in the medical beauty market along with botulinum toxin.

As the country increases its supervision of the medical beauty industry, more legal and compliant brands and products will be approved for listing, the injectable market will become more diversified and is expected to take over the upgrade of skin care consumption.

According to a report by Sullivan, the market size of China's medical beauty hyaluronic acid terminal products increased from 1.21 billion yuan in 2014 to 4.27 billion yuan in 2019, with a compound growth rate of 28.7%. It is expected that the market size will increase to 7.60 billion yuan in 2024.

There is no doubt that the expansion of new scenarios has become the key to brand success. Compared with the rich categories and larger scale of foreign markets, the domestic hyaluronic acid market still lacks sufficient development.

Nowadays, in addition to playing an important role in the field of medical beauty, hyaluronic acid is also gradually getting involved in the fields of food and daily chemicals. It is unknown whether it will become a popular material in all fields.